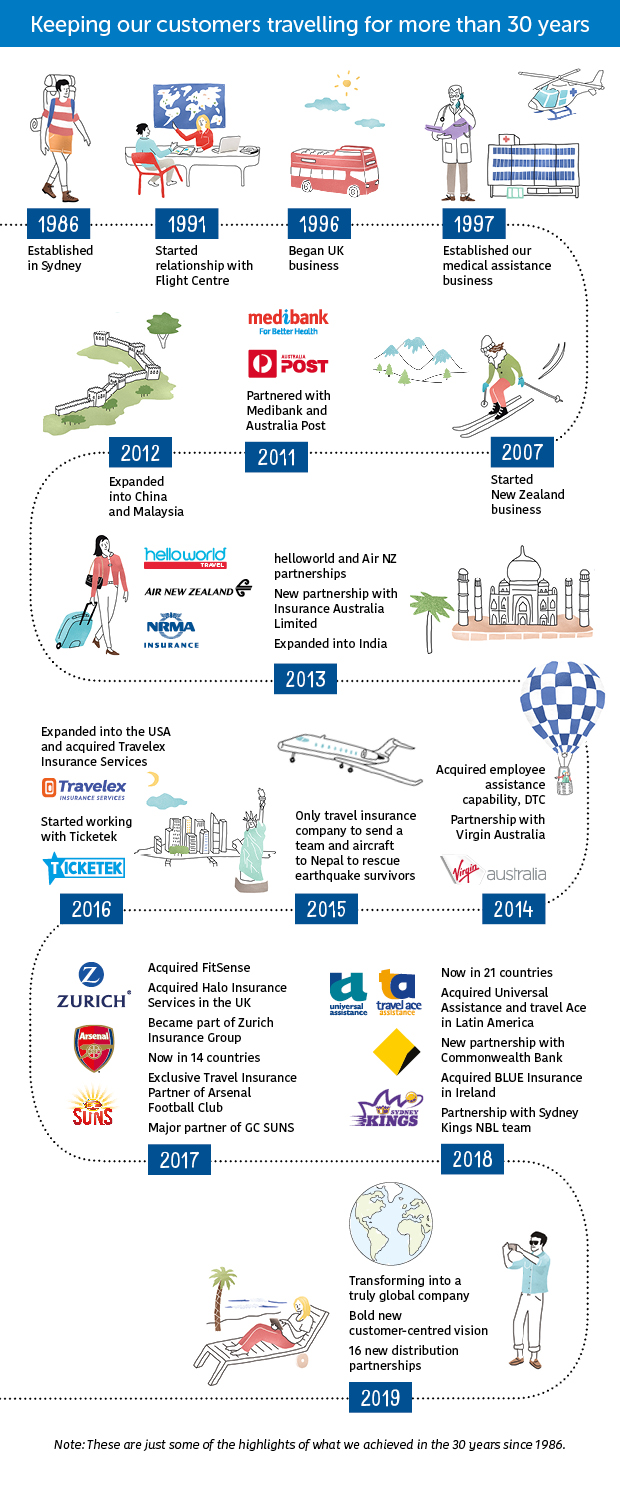

About Cover-More New Zealand travel insurance

Every year, more than 15 million people choose Cover-More worldwide.

Formerly known as Travelsure, Cover-More Travel Insurance has been providing travellers in New Zealand with high-quality travel insurance cover and round-the-clock customer service for many years.

Although we manage millions of policies and thousands of claims each year, we treat each customer with the individual care they deserve.

All our customers have access to 24-hour emergency assistance regardless of where they are in the world.

Zurich Insurance Group and Cover-More

Cover-More Group was acquired by Zurich Insurance Group in April 2017 and Zurich Australian Insurance Limited trading as Zurich New Zealand, will become Cover-More’s underwriter in New Zealand from 1 June 2017.

Zurich is one of the world’s leading multi-line insurers with about 54,000 employees. The group provides property and casualty, and life insurance products and services in more than 210 countries and territories. Zurich’s customers include individuals, small businesses and mid-sized and large companies, as well as multinational corporations.

Financial strength rating

An insurance company's financial strength can be defined as the company's claims-paying ability, that is, its ability to meet its obligations towards customers. In New Zealand, Zurich’s general insurance products are underwritten by Zurich Australian Insurance Limited (ZAIL), trading as Zurich New Zealand.

ZAIL has an insurer financial strength rating of A+ from Standard & Poor’s (Australia) Pty Ltd. This rating shows that the company has strong financial security characteristics. Standard & Poor’s rating scale for an insurer’s financial strength, together with a summary of Standard & Poor’s description is: AAA (Extremely Strong), AA (Very Strong), A (Strong), BBB (Good), BB (Marginal), B (Weak), CCC (Very Weak), CC (Extremely Weak), R (Regulatory Supervision), NR (Not Rated). Ratings from ‘AA’ to ‘CCC’ may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. For the most recent information on ZAIL’s financial strength visit http://www.zurich.co.nz/content/zurich_nz/about_us/financial-strength.html.

Further information on these ratings is also available from www.standardandpoors.com.

Physical address:

Cover-More Travel Insurance

Level 18

125 Queen Street

Auckland 1010

New Zealand

Postal address:

P.O. Box: 105-203

Auckland City 1143

New Zealand

About Cover-More New Zealand: Make-A-Wish

Cover-More supports Make-A-Wish children and their families in facilitating their wishes, by providing travel insurance for their overseas trip organised by the team at Make-A-Wish.

The key mission of Make-A-Wish is to grant the special wishes of children with life-threatening medical conditions to give them hope, strength and joy at a very difficult time in their lives.

Some of the trips that have been made possible (by the pre-approval of the medical team at Cover-More) include theme parks in Australia, as well as trips to Europe and the USA meeting celebrities.

- Angus was able to fly to Sydney with his family to watch the All Blacks win the Bledisloe Cup with Cover-More travel insurance.

- Samuel's one true wish was to go to a Parramatta Eels game in Sydney and meet the team - Cover-More provided travel insurance for Samuel and his family.

- Samara wanted to go to the Gold Coast, Australia to visit a close family friend and to see the dolphins at SeaWorld Australia.

- Ela-Huia's wish was to go to the Theme Parks on the Gold Coast, Australia and wants to go back again next year!

- Ryu and his family headed to MovieWorld on the Gold Coast, Australia and hugged koalas and fed kangaroos!

Cover-More is committed to supporting the valuable work of this phenomenal organisation and we gift travel insurance policies to children and their families each year in order to grant their wishes where overseas travel is required. To date, we have covered overseas trips for 68 wishes.

Cover-More New Zealand is committed to helping Make-A-Wish

Cover-More BDM Kim T helping out at a Make-A-Wish Fundraiser

Cover-More Head Office team dressing up for "I Wish I Was" day

You can find out more about Make-A-Wish New Zealand and donate to the cause via their website https://www.makeawish.org.nz/

About Cover-More New Zealand: customer testimonials

Cover-More customer testimonials

Customers share first-hand proof of the value of Cover-More Travel Insurance

If you’ve wondered why you should buy travel insurance, ask these Cover-More customers.

Each of them encountered an unfortunate unexpected event that threatened their travel plans, their health, or in a few cases, even their lives. And in each case, Cover-More Travel Insurance came to the rescue.

We not only provided money to cover their claims, but just as important, provided superior assistance and support. Although we are never happy when one of our customers experiences a problem on their trip, we are proud to be able to come to their aid. Anytime. Anywhere.

Jean: “I will always use Cover-More”

Jean was fulfilling a long-held dream of trekking to Mount Everest Base Camp in Nepal when she injured her ankle. Cover-More came to the rescue by arranging the airlift from Mount Everest to Kathmandu and then after treatment, bringing her back home.

Mark: “From the moment I contacted Cover-More, I didn't have anything else to worry about.”

Mark and Julie decided to go to India to see the Taj Mahal. Julie suffered two spinal compression fractures when the bus she was travelling on drove over a pothole on the way to visit a tiger reserve in India.

More testimonials from Cover-More customers

"From the time I made the first phone call, Cover-More kept calling me to check on Liam and make sure he was OK and that we were being looked after. The reassuring voice on the other end of the phone was wonderful. To get the help we did, and Cover-More organised everything so easily, it was just amazing. We would have been stuck without our travel insurance." - Paula Fryer

Six-year-old Liam, who lives with Type 1 diabetes, contracted a virus on holiday with this family in Fiji.

Quick facts:

• Paula booked the family’s first holiday to Fiji in October 2017, and on the advice of her travel agent, bought a family policy with us. In December that year, Liam was diagnosed with Type 1 diabetes, so she made sure their agent noted this in their policy as a new medical condition. Paula says their travel agent assured her they could rely on us for anything they needed while they were in Fiji

• In April 2018 the family departed for their holiday and enjoyed a week on Plantation Island. The day before they were due to start their journey home, Liam woke up with low blood sugar. Paula treated it in the normal way, but before long Liam started vomiting

• Paula took Liam to the island’s medical centre where they ran some tests and found the presence of ketones, a sign his insulin levels were low. Liam needed IV fluids and glucose, so Paula called our 24/7 medical assistance team

• After discussing Liam’s condition with Paula, we agreed we needed to get Liam to Nadi ASAP for medical treatment

• Within an hour of Paula’s first call to us, our helicopter landed at Plantation Island to medevac Liam to Nadi. One of our registered nurses met the helicopter at the airport and escorted Liam and Paula to a nearby, private medical centre

• Liam spent the afternoon in the medical centre, where tests showed he’d contracted a virus and his diabetic symptoms were a subsequent complication. He spent an extra night with his family in Nadi to ensure he was fit to fly home two days later and fortunately he’s made a full recovery

How we helped

Ketoacidosis can be life-threatening, so it was essential we got Liam to Nadi very quickly. We arranged the helicopter for Liam, as well as the medical escort and treatment in Nadi to ensure Liam received the urgent medical care he needed. We covered all expenses, including the helicopter, extra accommodation and transfers.

The challenges

Plantation Island is one of Fiji’s most beautiful islands and it’s very popular with families, but its medical facilities are better suited to treating basic holiday illnesses and injuries. When Liam’s condition was rapidly deteriorating it was essential we flew him to Nadi for potentially life-saving treatment

Policy price: |

Claim cost: |

|---|---|

| $300 | $2,140 |

Keep travelling tip:

Travel insurance allows you to visit remote and beautiful destinations knowing that if you or your family need help you have the cover and expertise available to get you to the best available medical care.

"You guys have been great. This is the third year in a row I've taken out a policy with you and I will again. I'm so thankful Cover-More took care of me." - Pieter van den Berg

During a skydiving holiday to the US, Pieter hit the ground at 100kms per hour in a landing that went horribly wrong.

Quick facts:

• Pieter is a passionate and highly experienced skydiver. After skydiving for several months around the US, Pieter attempted an advanced landing manoeuvre he’d been practising for some time. Unfortunately, it went wrong and he hit the ground at 100 kilometres per hour

• People rushed to help Pieter. Fortunately for him, the group included a thoracic surgeon who stabilised his neck

• A medivac helicopter happened to be in the area, so its medical team stabilised Pieter before flying him to Riverside Medical Centre

• X-rays and scans showed Pieter had suffered a split and distended pelvis, as well as a fractured back, elbow and ankle. He was put into an induced coma and we flew Pieter’s partner Sue to the US to be with him

• Seven surgeons, including one of the world’s leading pelvic surgeons, operated on Pieter for seven hours

• A week later Pieter underwent a second surgery to further stabilise his pelvis

• He spent two weeks in hospital and then another two in a rehabilitation centre before our nurses medically escorted him home

How we helped

Our medical assistance team was in touch with Pieter and Sue every day. We also liaised with Pieter’s medical team and oversaw his treatment. When it was time for Pieter to fly home we made his travel arrangements and two of our registered nurses medically escorted Pieter from the US to hospital in New Zealand. We covered Pieter’s medical and transport costs in full, as well as Sue’s travel and expenses while she was in the US.

The challenges

Pieter’s accident could have been much worse, with some of his surgeons saying they had never seen injuries as serious as his.

Policy price: |

Claim cost: |

|---|---|

| $730 | $746,000 |

Keep travelling tip:

Pieter’s policy included cover for one of the world’s riskiest sports, so when he crashed he had access to the best possible medical care at no cost. Without insurance, paying his own medical bills may have impacted Pieter for the rest of his life.

"When the x-ray showed I had a fractured fibula I thought, ‘I need to call Cover-More’. They were really helpful. I spoke to them every day and they were always wonderful, especially the nurse who helped me home." - Loeng Liev

Loeng fractured her fibula walking down a mountain in Cambodia.

Quick facts:

• Loeng fell walking down a mountain and thought she’d sprained her ankle. With no help nearby, she hobbled to the bottom

• Several hours later, Loeng went to hospital and an x-ray showed she’d fractured her fibula (calf bone). She was fitted with a cast and given crutches

• Loeng called our 24/7 medical assistance team and one of our doctors assessed her. We advised we’d be arranging new business class flights and a medical escort with one of our dedicated Registered Nurses for her trip home

• One week later, once the swelling had reduced and she was fit to fly, our nurse met Loeng in Pnomh Penh and managed her transition through the airports and onto the planes, as well as monitoring her to ensure she was safe and comfortable throughout the journey. People who travel with fractured bones are at increased risk of deep vein thrombosis (DVT) due to swelling and immobility

• Loeng, together with our nurse, made the journey home comfortably and she is expected to make a full recovery

How we helped

We oversaw Loeng’s medical care in Cambodia, our nurse helped her home, and we booked business class seats for the return trip so she could keep her leg elevated, minimising the risk of DVT.

The challenges

There were no challenges in this case. Loeng received excellent medical care in Cambodia and our nurse made sure her journey home was safe and as easy as possible.

Policy price: |

Claim cost: |

|---|---|

| $498 | $20,860 |

Keep travelling tip:

Loeng was travelling alone, so we sent one of our Registered Nurses to escort her home. Her policy covered the cost of her medical care in Cambodia, new business class flights, and a medical escort.

"I was incredibly stressed and frightened because I was alone, but Cover-More made it so much better. I don’t know how I would have coped without them. They deserve their dues because the team was awesome." - Heather Leigh

Heather came down with severe gastroenteritis in Delhi airport, India while waiting for a flight.

Quick facts:

• Heather had finished a three-week group tour from Nepal to India when she started to feel ill as she was checking in for her flight to Kuala Lumpur, the first leg of her journey home

• Within an hour Heather was so ill the airport staff checked her into the sickbay and once she was on the flight she endured five hours in the bathroom

• Heather arrived in Kuala Lumpur, went straight to her hotel and slept for several hours. When she woke up Heather called our 24/7 medical assistance line and we gave her the details of a nearby private hospital

• The hospital required a $1,000 deposit prior to admission, but Heather’s funds were depleted due to the Black Money event in India (which saw the government declare all 500 and 1,000 Rupee notes invalid, so Heather had to pay for everything on her credit card). We fast-tracked Heather’s claim for the admission and the funds were in her account within 48 hours

• Heather spent a day in hospital undergoing tests and she was given an IV for rehydration

• After three days in Kuala Lumpur, Heather was cleared to fly home. Still very sick, tests in New Zealand showed Heather had shigella, a bacterial infection. She spent several weeks seriously ill

How we helped

We helped Heather find one of the best hospitals in Kuala Lumpur when she urgently needed medical care. We covered her medical costs, and her additional accommodation, incidentals and cancelled tours.

The challenges

Heather forced herself onto her flight to Malaysia because she wanted to access the high-quality medical care available there.

Policy price: |

Claim cost: |

|---|---|

| $107 | $1,223 |

Keep travelling tip:

Heather’s policy, and access to our 24/7 medical assistance team, meant she could access the best possible medical care no matter where she was in the world.

"We’ve always travelled with Cover-More travel insurance, but we’ve never had to use it. The service we received in the Cook Islands was an eye-opener. It took the stress of the whole ordeal away from my partner Terry, especially as we were told we would be covered if we had to stay longer in Rarotonga. We want to tell as many people as we can about the help we received. Our claim was approved so quickly, I can’t get over how quickly it came through." - Bert Wall

Bert experienced heavy and hard to diagnose rectal bleeding during an island holiday.

Quick facts:

• On the third night of his holiday, Bert went to the bathroom to find he was bleeding heavily

• Bert’s wife Terry called an ambulance and he was taken to the only hospital on the island. Bert needed three blood transfusions in the hospital in Rarotonga

• The local doctor recommended Bert fly home to New Zealand for medical treatment as soon as possible

• Bert’s condition needed to be stabilised before he and Terry could fly home, so our medical assistance team started liaising with the hospital staff to assist with Bert’s treatment

• Our doctors and nurses worked with the hospital staff over the coming days to ensure Bert received appropriate medical care

• Bert flew home and his local GP advised the bleeding might have been caused by a procedure Bert underwent just prior to the holiday. Bert’s blood count took several months to recover from his significant blood loss

How we helped

Our medical assistance team ensured Bert received high-quality medical care in the Cook Islands where hospital facilities are limited, as Bert was unable to fly home. We covered Bert’s medical expenses and cancellation costs.

The challenges

Bert required expert medical care for a hard-to-diagnose condition in an area where the local hospital had one doctor.

Policy price: |

Claim cost: |

|---|---|

| $200 | $1,823 |

Keep travelling tip:

While he was in the Cook Islands unable to fly home, our medical assistance team ensured Bert received the level of high-quality medical care he would have been able to access in New Zealand.

"With all the help and care that I got, I’ve really dodged a bullet, and I couldn’t ask for anything more. The care from everyone... especially the boys on the plane, they were just marvellous. The medical assistance team rang once a day to check-in and make sure we were all right. All they were doing was keeping us informed and it helped so much. With Cover-More and the air ambulance, the keeping in touch was just amazing." - Tom Nesbitt

Our customer had a stroke on the first day of his holiday on the Cook Islands.

Our mission?

To ensure our customer received the best possible medical care when he had a stroke in Rarotonga, Cook Islands.

Who did we help?

Tom Nesbitt, who was on an eight-day holiday to the Cook Islands with his wife, Mary.

What was their situation?

After arriving in Rarotonga from Auckland in the late afternoon, Tom and Mary decided to watch the All Blacks play a match on television before an early dinner and bed, so that they were ready to embrace the first day of their holiday the following morning.

What happened?

Tom woke up at 5 am the following morning, and as he got out of the bed and walked across their hotel room, he collapsed. Tom knew he’d had a stroke almost straight away, as he couldn’t move his left leg, arm or hand. Mary called reception to get help for Tom and he was immediately taken to Rarotonga Hospital. The medical and nursing staff at Rarotonga Hospital were wonderful, qualified, attentive and responsive, however, due to its location, the specialist care it was able to provide was restricted.

How did we help?

As soon as Tom was admitted to the local hospital, Mary called our medical assistance team to advise us of Tom’s situation. We spoke with Mary, and Tom’s treating team, to determine his status and agree on the best course of treatment for Tom. Due to the facilities available at the hospital, we knew very quickly that we needed to get Tom out of Rarotonga to Auckland for specialist treatment.

What happened next?

We started making arrangements for an air ambulance to fly to Rarotonga to collect Tom and Mary and make the flight to Auckland. Our doctor and paramedic arrived in the evening ahead of their departure with Tom and Mary at 8 am the following morning. Our medical team checked Tom to ensure he was looking ‘fit to fly’ on the air ambulance the following morning. The next morning an ambulance transferred Tom and Mary from Rarotonga Hospital to the airport where our air ambulance, doctor and paramedic were waiting. They flew to Auckland via Tonga, as the pilot had to stop to refuel.

What was the outcome?

An ambulance met the plane on the tarmac at Auckland International Airport. Fortunately, Tom and Mary’s son and daughter-in-law were able to meet the flight on the tarmac as well, and they followed the ambulance from the airport to Middlemore Hospital. Tom spent six nights in Middlemore Hospital where he was seen by specialists and physiotherapists. He was discharged and is now recuperating at home, together with regular medical and physio appointments. According to Tom, his doctors are very pleased with how well he is recovering from the stroke, but he’d like it to be faster.

THE CHALLENGES

• Ensuring our customer received the best possible, immediate medical care when he had a stroke in Rarotonga, Cook Islands

• Arranging an air ambulance as quickly as possible to transfer our customer from the Cook Islands to Auckland for specialist treatment

THE CASE

• Our customer Tom had a stroke on the first morning of his holiday to the Cook Islands with his wife of 43 years

• He lost movement down his left side, including his arm, hand and leg

• Tom and his wife were transferred via an air ambulance from Rarotonga to Auckland for specialist medical care

• Tom is recovering well

CLAIM COST

NZD $114,780

"When I was in hospital I spoke to Cover-More every day, and because I was in Bali on my own that was so reassuring. Dengue fever is debilitating, so it was awesome that my policy paid for me to stay in Bali for another week after I left the hospital and I could recover before going home." - Senka Radonich

Senka contracted dengue fever in Bali.

Quick facts:

• Senka had spent two weeks in Bali surfing and relaxing ahead of a week-long personal and professional development workshop. Two days into the workshop she started to feel unwell with a fever and chills

• Senka put up with it for 36 hours before she started Googling her symptoms and decided to call our 24/7 medical assistance line. Our nurse discussed Senka’s symptoms with her and confirmed she needed to see a doctor asap, as they were consistent with dengue fever

• As it was 4 am Bali time and her hotel reception was closed, Senka drove herself to the closest medical centre 10 minutes away. Blood tests showed Senka’s platelet levels were dangerously low, so the medical centre called an ambulance to take her to hospital

• There is no cure for dengue. The approach to medical care is managing pain and nausea, maintaining hydration and monitoring for any spontaneous bleeding due to reduced platelet levels

• Senka spent five days in hospital until her platelet count increased. We checked in on Senka every day to ensure her treatment was progressing well

• Even though she was due to fly home two days after she was discharged from hospital, Senka spent another week in Bali recovering before she was fit to fly home

How we helped

We helped Senka get medical care when she urgently needed it in the early hours of the morning. We paid for her medical expenses in Bali and her accommodation, additional expenses and flights when she needed to stay in Bali longer than planned.

The challenges

Initially, it was thought Senka could manage the dengue fever out of the hospital with the right medications, but when tests showed her platelet count was dangerously low she was taken to hospital.

Policy price: |

Claim cost: |

|---|---|

| $120 | $1,637 |

Keep travelling tip:

Senka’s policy not only meant she could access the best possible medical care, but it also enabled her to stay in Bali longer than planned and all her expenses were covered.

“Cover-More has been absolutely fantastic, I cannot fault them. They were in touch with me every day and they checked up on us to make sure dad was OK. They also reassured us our accommodation and extras were paid for. It was nice to know they cared. I’m raving about Cover-More to everyone.” Diane Chettleburgh

John fractured his hip and required surgery on holiday in Australia.

Quick facts:

• John and Gaynor’s daughter Diane takes per parents to Australia every year to visit their son who lives in Queensland. John has diabetes and emphysema, and Diane declared his conditions when she bought their policy, ensuring he was covered in full. Unfortunately, on the last day of their holiday, John slipped on wet tiles and couldn’t get up

• An ambulance took John to hospital and Diane called our 24/7 medical assistance team on the way. Scans showed John had fractured his hip and the hospital advised he needed surgery. The operation went well, but John experienced complications with blood pressure and delirium following the anaesthetic, so he spent three weeks in hospital

• We arranged and paid for Gaynor and Diane to stay in accommodation close-by so they could be with John as much as possible

• We were also on the phone to Diane every day to check on John’s progress, and we liaised with his medical team to ensure he was receiving the best possible care

• When John was ‘fit to fly’, our Registered Nurse arrived at his bedside and escorted him from Australia to hospital in Dunedin. She ensured he was stable and comfortable throughout the journey, as well as managing the handover between the medical teams at each hospital

• At the time of writing, John remains in hospital where he is recovering

How we helped

We covered the cost of John’s medical care in Australia and our Registered Nurse escorted him back to New Zealand. We also covered the cost of new flights for John, Gaynor and Diane, as well as accommodation and incidentals for Gaynor and Diane while John was in the hospital.

The challenges

John is elderly, and lives with diabetes and emphysema, so, unfortunately, he was more inclined to experience complications following surgery.

Policy price: |

Claim cost: |

|---|---|

| $210 | $10,933 |

Keep travelling tip:

The cover our policies provide has helped John and Gaynor to travel overseas well into their '80s, with the reassurance they have access to the best possible care if something does go wrong. We helped John and Gaynor to keep travelling.